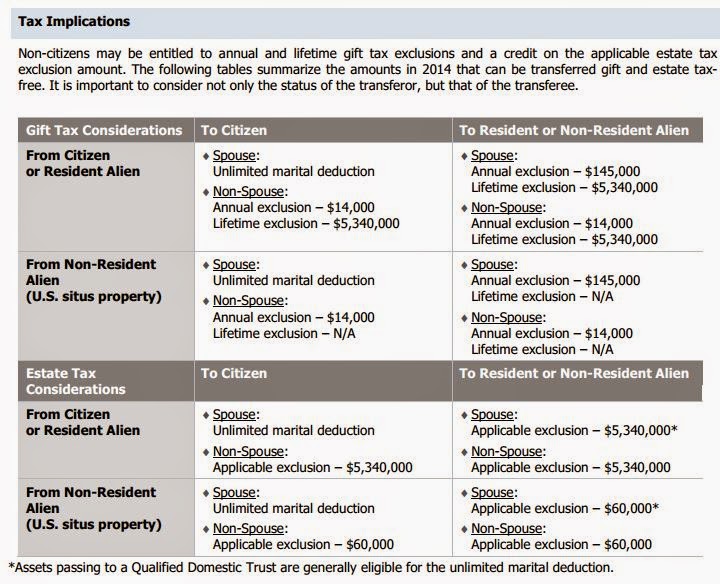

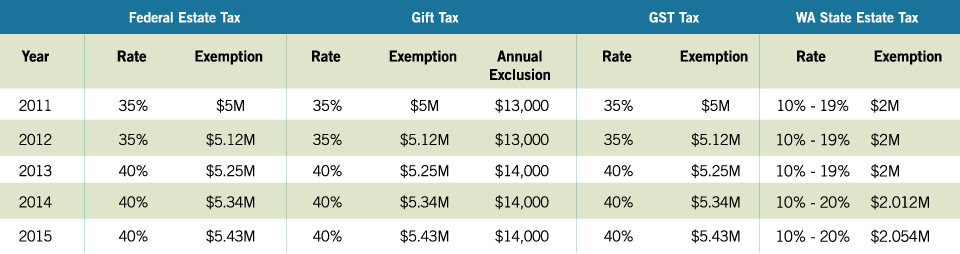

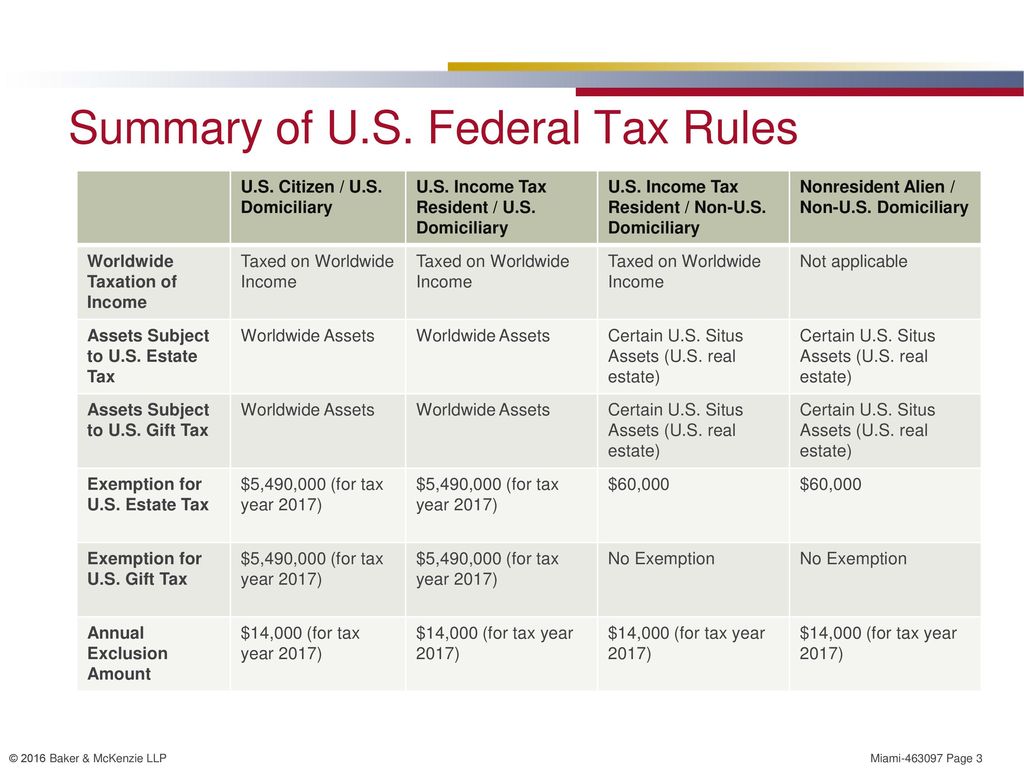

The Tax Times: US Property Passing to Your Surviving Spouse Does Not Always Qualify for the Marital Deduction!

Gifting to U.S. Persons: A Guide for Foreign Nationals and U.S. Donees | BNY Mellon Wealth Management

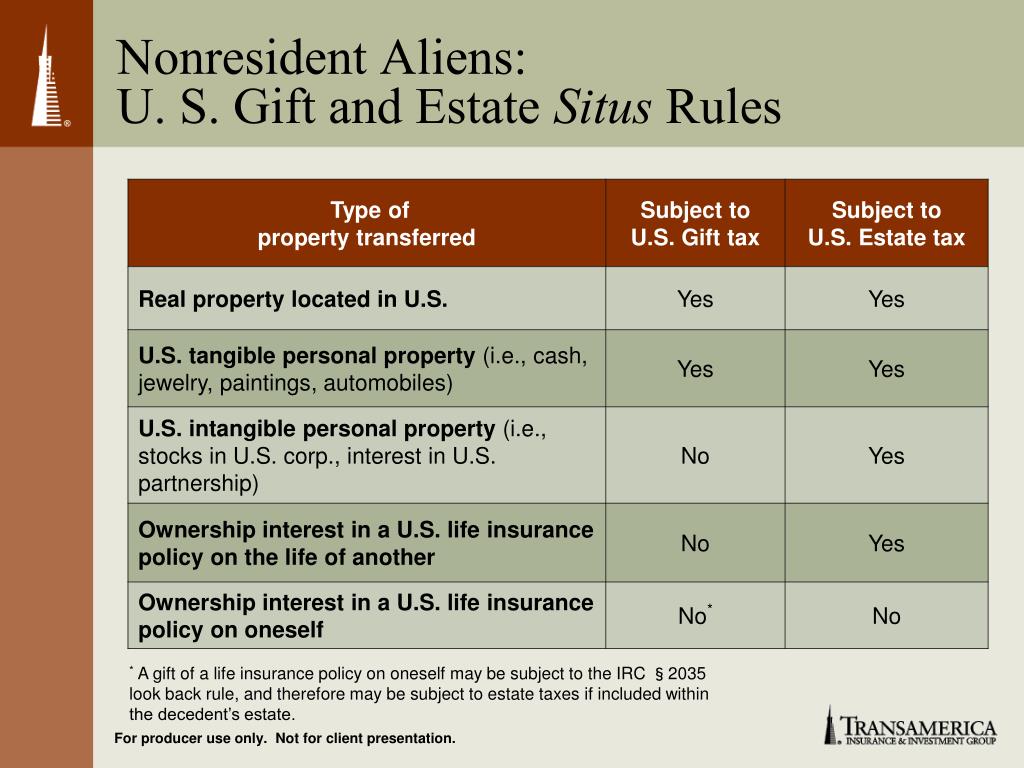

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL