Tax Receivable Agreement Ppt Powerpoint Presentation Professional Icon Cpb | Presentation Graphics | Presentation PowerPoint Example | Slide Templates

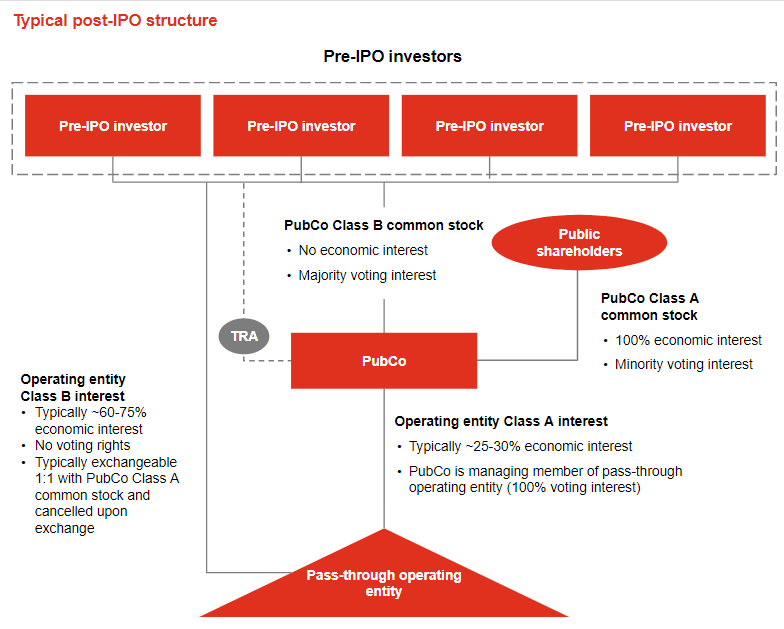

Tax receivable agreements in initial public offerings: An analysis of the innovation incorporated in IPO agreements

Tax receivable agreements in initial public offerings: An analysis of the innovation incorporated in IPO agreements | Semantic Scholar

The Tax Receivable Agreement of the Red Rock Resorts IPO – Red Rock Resort/Station Casinos IPO Dissected