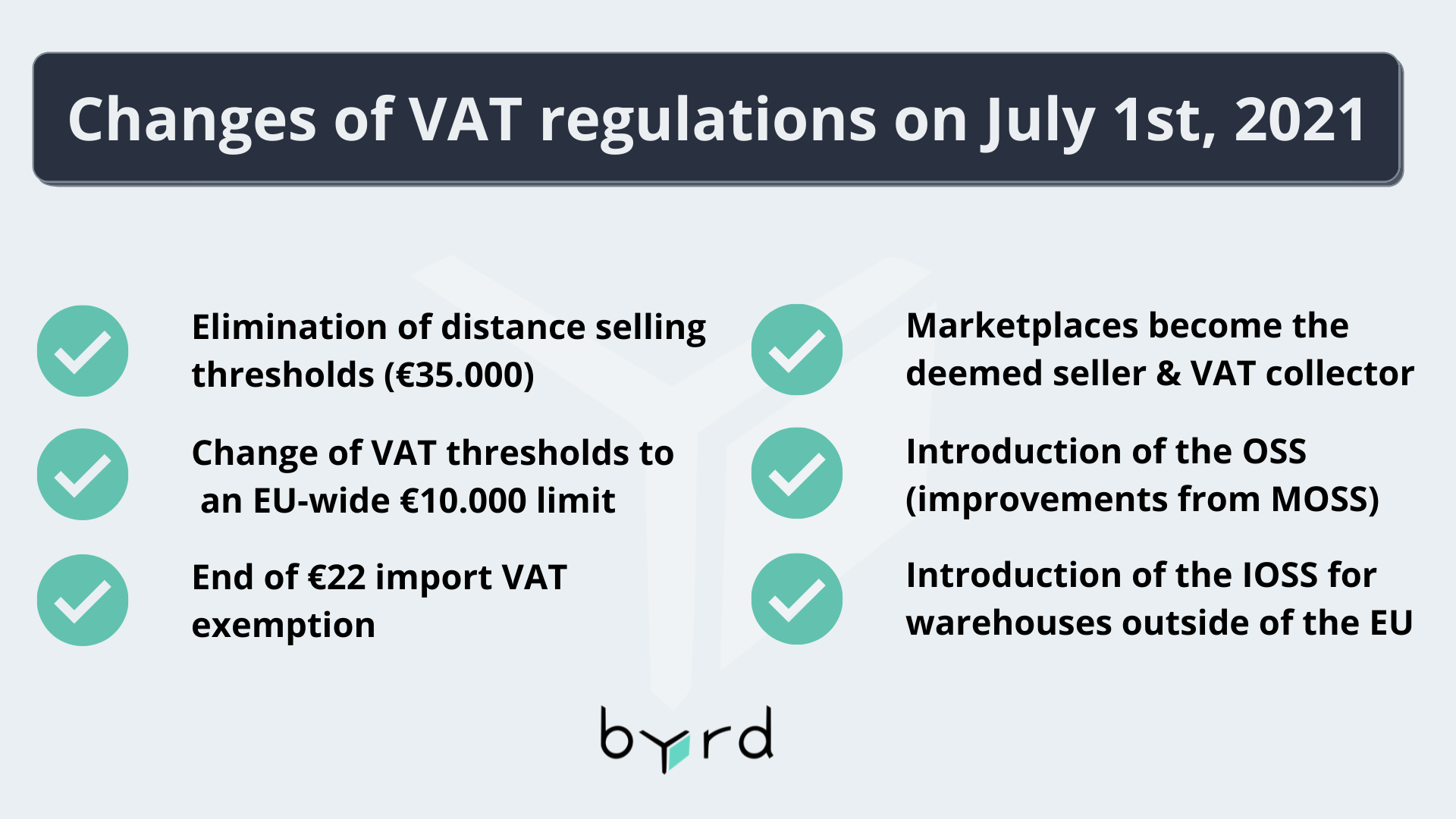

Goodbye distance selling thresholds - Hello OSS: What will change for almost all European online merchants as of July 1st - E-commerce Germany News

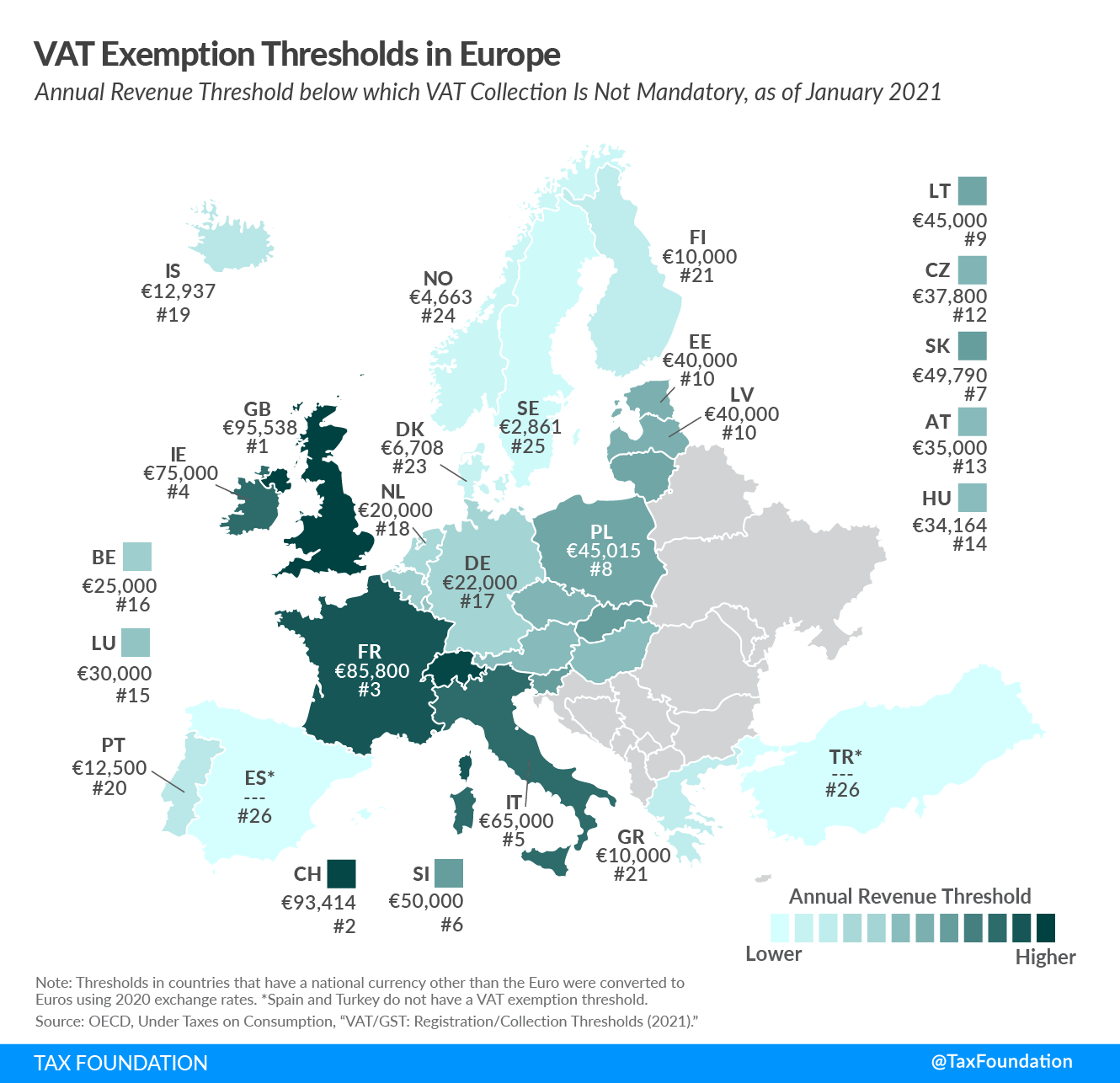

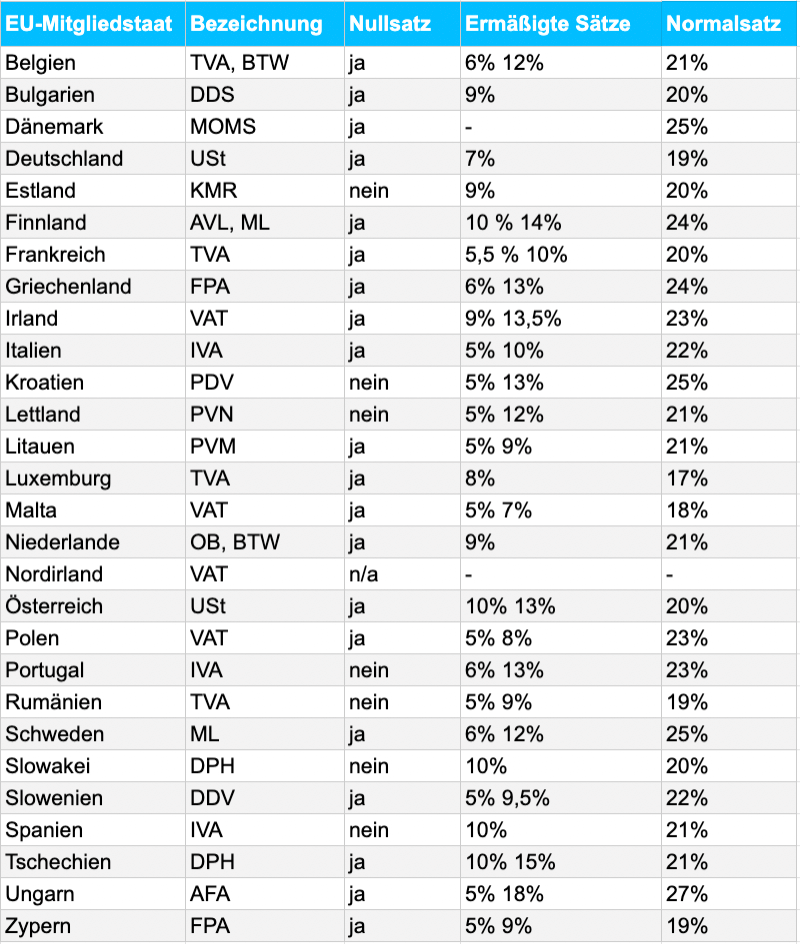

Dying Victims Productions - Important info for EU-customers! ++ European Union VAT reform from 1 July 2021 ++ From July 2021 onwards, an important change of how taxes on e-commerce sales are