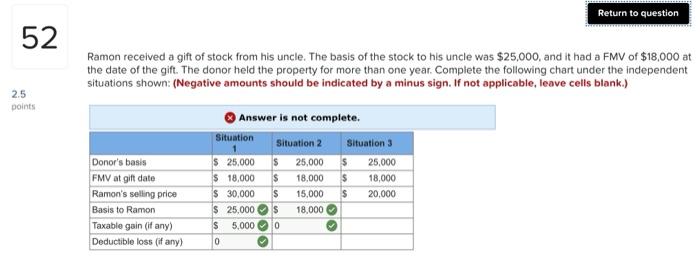

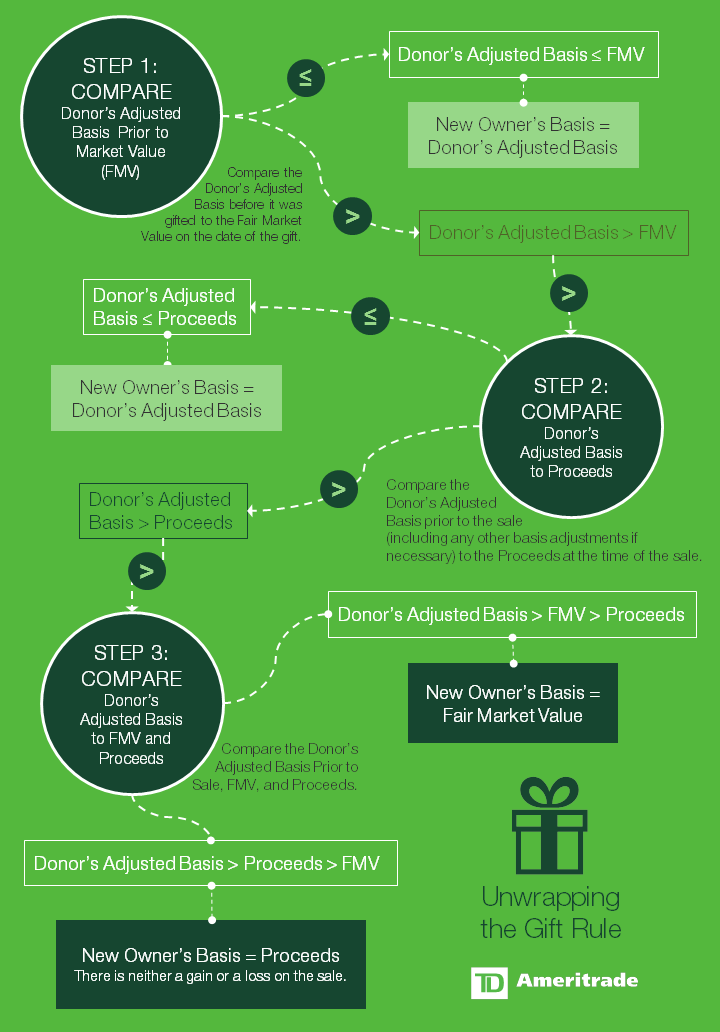

Ask the Hammer: What is the Recipients Tax Basis on Gifted Stock? - Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More

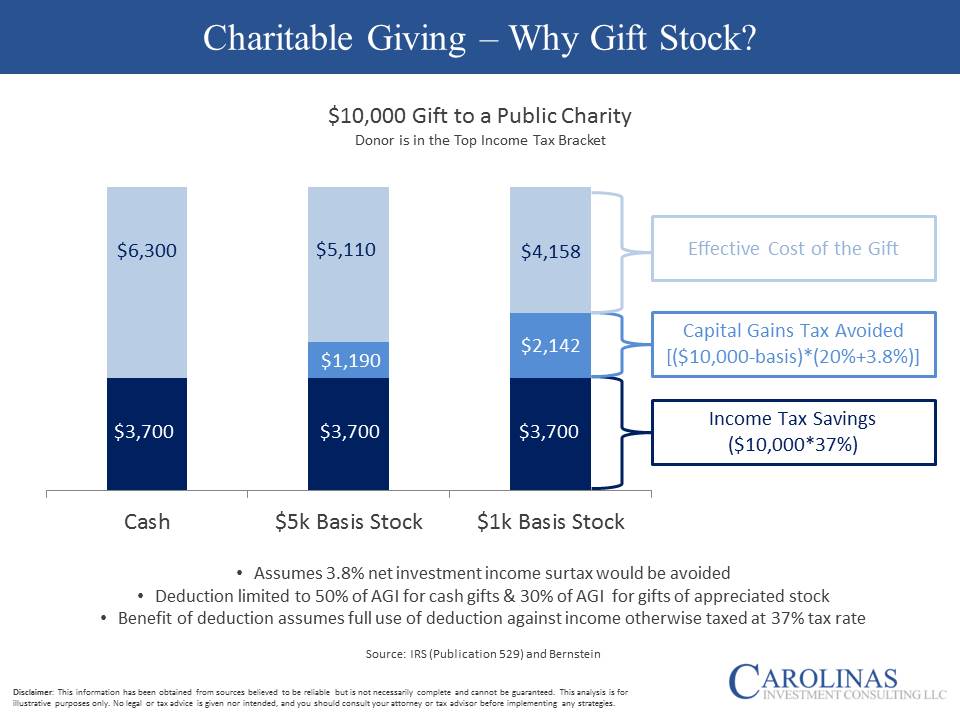

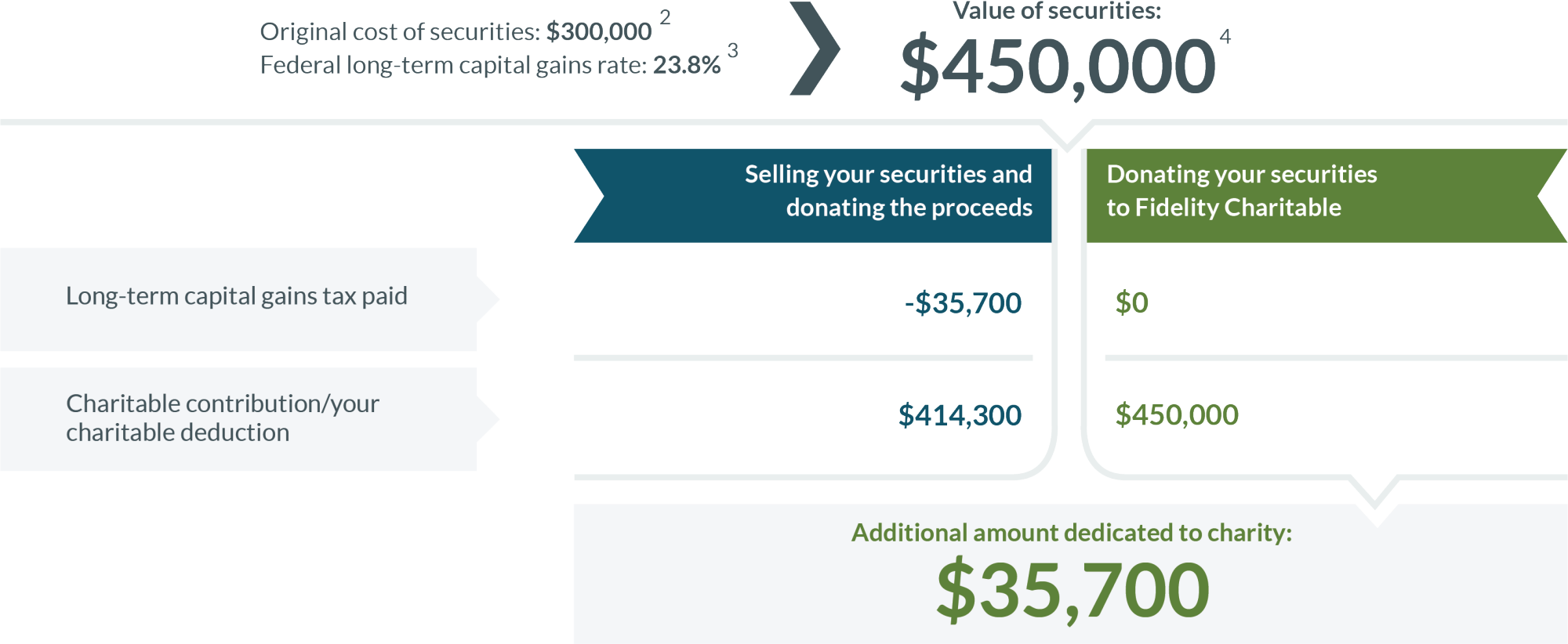

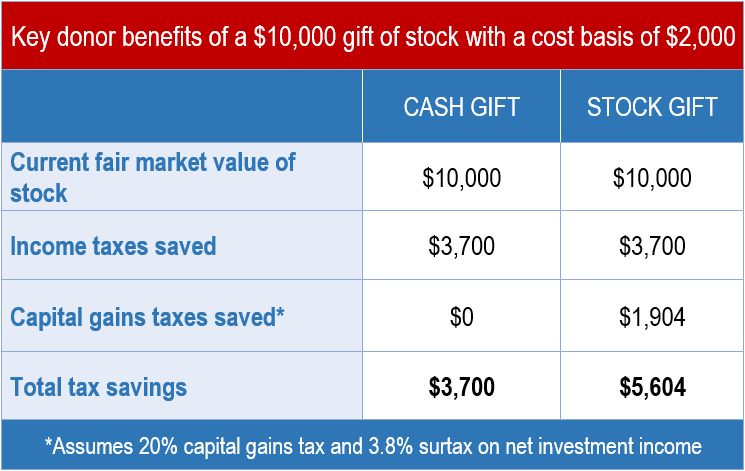

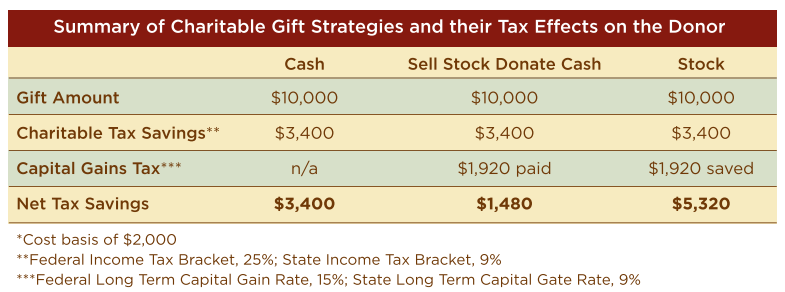

One simple (and unknown) trick that will increase your tax savings by more than 50% on your charitable contributions - A Place Of Possibility